by Georgina Maka’a

Solomon Islands Government is closely watching the ongoing tariff war between the United States and China, and is taking steps to limit its impacts on the country.

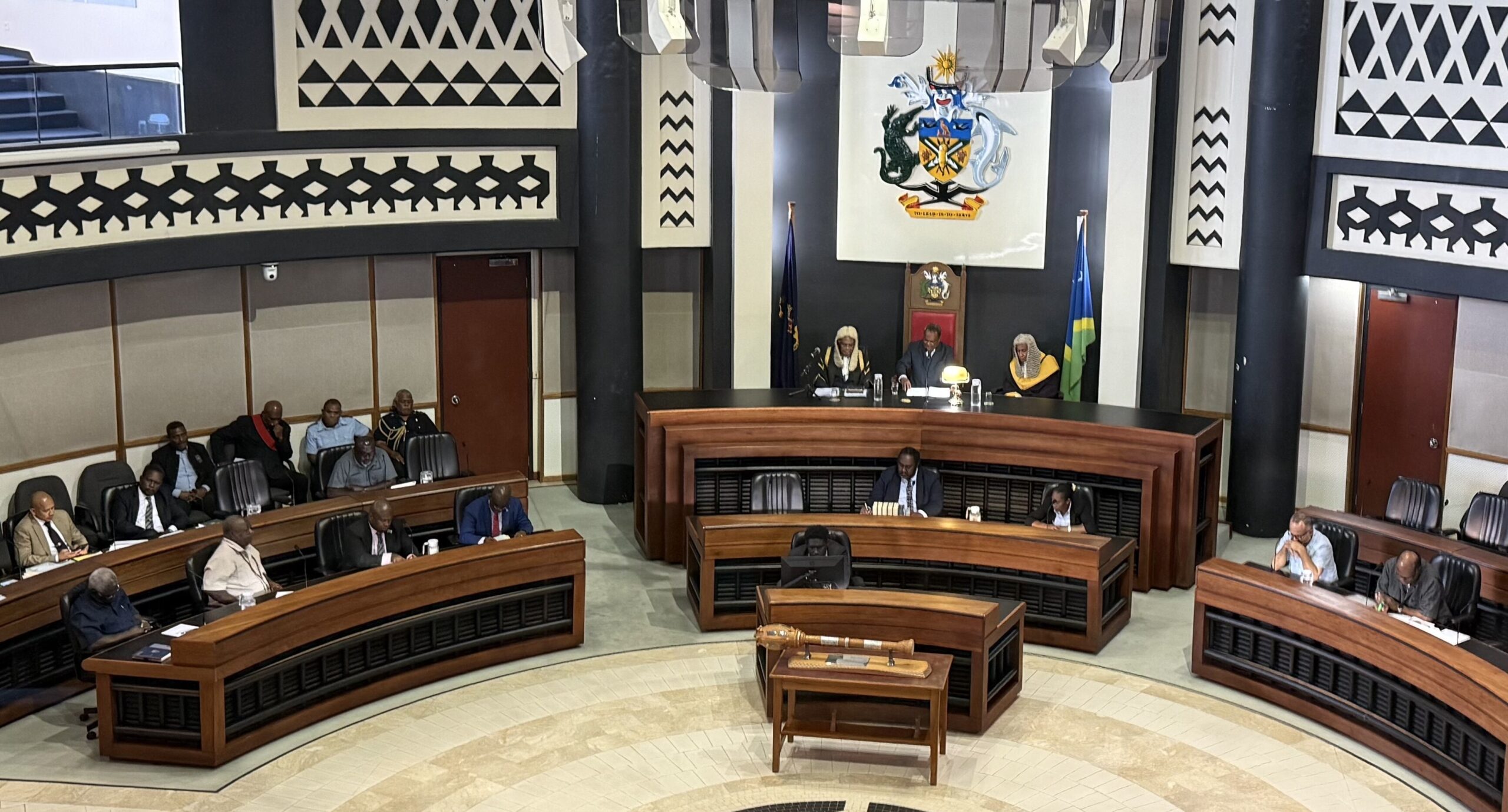

Governor General Sir David Tiva Kapu highlighted this when he delivered the traditional speech from the throne in parliament this morning.

Solomon Islands, Kapu stated, is affected by US President Donald Trump’s reciprocal tariff baseline of 10%, while some neighboring countries face much higher tariffs—Fiji at 32%, Nauru at 30%, and Vanuatu at 22%.

“This is a competitive advantage for the country’s kava exporters to the United States,” the Governor General said.

Earlier, Prime Minister Jeremiah Manele says the direct impact of the tariff war on the country will be minimal — although indirect effects through affected development partners remain a concern.

Manele said the recent 10 percent U.S. tariff on imports will have limited effect on the Solomon Islands’ economy due to the country’s relatively small trade volume with the U.S.

“Trade between Solomon Islands and the United States is estimated at just USD$2 million to $5 million annually,”the prime minister said.

“I believe it mainly concerns kava exports to the U.S., so we may not feel the impact directly to a significant degree,” he added.

However, he warned that the broader consequences of the U.S.-China tariff war could affect the Solomon Islands indirectly.

“Some of our development partners are facing much higher tariffs. That could affect their economic development and, in turn, their ability to support us,” Manele explained.

To understand the possible long-term implications, the Prime Minister has instructed the Economic Reform Unit (ERU), the Central Bank of Solomon Islands, and the Policy Evaluation team to conduct a detailed analysis.

Meanwhile, Governor General Kapu said the $5.2 billion 2025 budget parliament passed last December include an overall deficit of $1.274 billion, mainly due to development expenses.

To address this shortfall, he said Cabinet has endorsed the 2025 SIG Expenditure and Financing Strategy.

“The 2025 Budget is themed: ‘Accelerating Accountable and Transformative Investments: A Pathway Towards a Resilient and Sustainable Economy,’” he said.

“Consultations for the 2026 Budget framework have already started.”

Governor General Kapu emphasized the need for budget allocations to align with strategic priorities.

With limited resources, he said focus should be on areas of advantage, enhancing rural participation, and adopting a private sector-led approach to developing productive and resource sectors.

“As part of ongoing fiscal reforms, the government is also reviewing the national tax system. The goal is to create a fair, simple, and broad-based tax system that ensures everyone pays their fair share.”

Kapu told parliament the tax reform will be implemented in phases:

- Phase 1: Includes the Tax Administration Act, which has already passed, and the upcoming Value-Added Tax Act, expected to be introduced in Parliament soon.

- Phase 2: Started in 2024 with Cabinet approval of key policy directions, which will involve reforms to the Income Tax Act, along with reviews of excise and resource rent taxes.