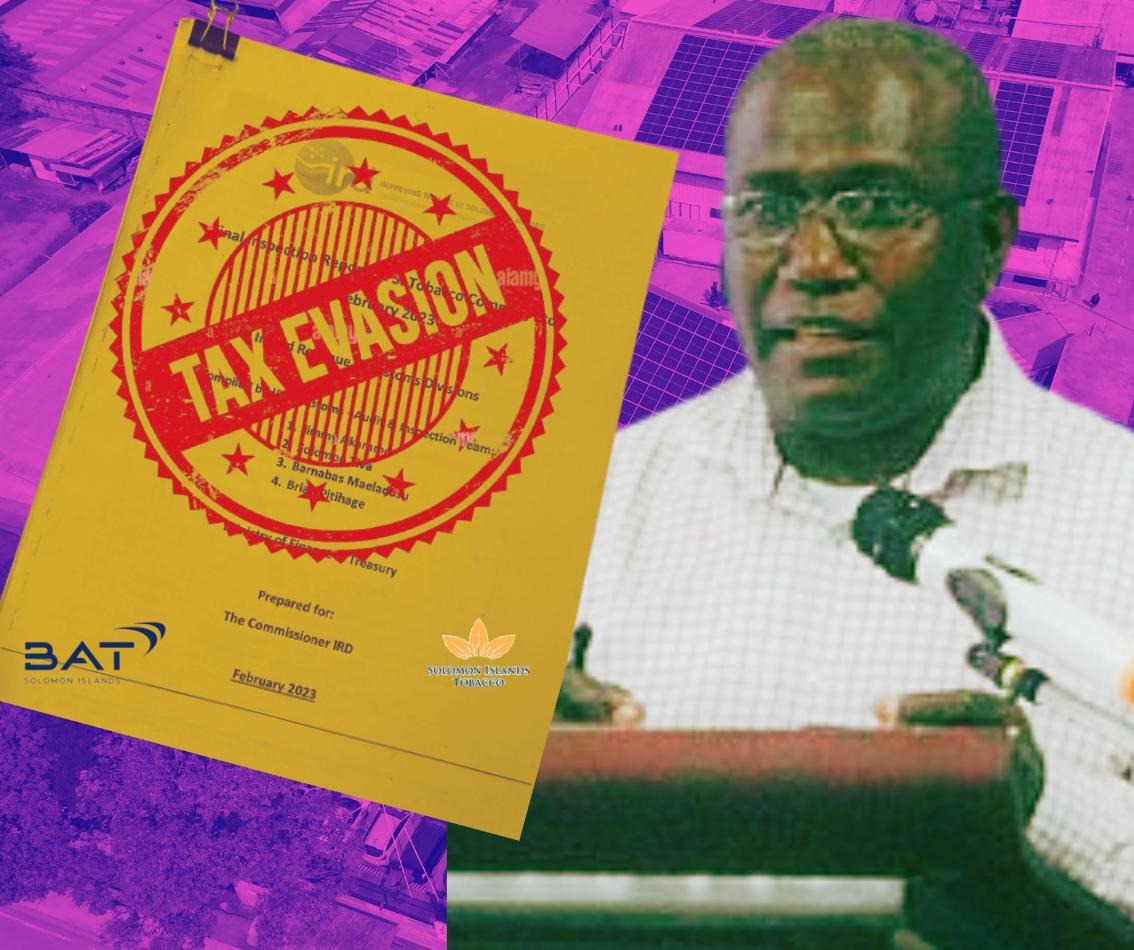

A massive $85 billion tax discrepancy, reportedly uncovered by auditors investigating the tax affairs of Solomon Islands Tobacco Company Ltd (SITCO), has triggered a sharp internal rift within the Inland Revenue Division (IRD) — the government agency responsible for tax collection. IRD Commissioner Joseph Dokekana dismissed the assessment as unrealistic, but his auditors defended their findings, insisting they were based on official source documents. OFANI EREMAE reports:

Key Findings:

- Solomon Islands Inland Revenue Division (IRD) audit team uncovered an $85 billion tax discrepancy linked to Solomon Islands Tobacco Company Ltd (SITCO), based on official customs and tax documents from 2015 to 2021. However, IRD Commissioner Joseph Dokekana rejected the findings, calling them “unrealistic” and withdrew the assessment, causing significant internal tensions within the agency.

- The audit team’s assessment was based on verified customs declarations (IM4 and IM7) and physical inspections, which identified under-declared imports, inconsistent tax filings, and missing statutory reports.

- The Commissioner allegedly withdrew the tax assessment without following legal procedures, including not allowing SITCO to formally respond as required under tax law. Auditors claim this decision followed a private meeting with SITCO and may have involved external pressure or intimidation, raising concerns about transparency and governance.

- The audit team escalated the matter to various government bodies, including the Ministry of Health, the Attorney General, and the police. Legal experts and independent auditors criticized the Commissioner’s actions, saying that proper legal processes were bypassed and that the credibility of the audit warranted formal dispute resolution rather than unilateral withdrawal.

In November 2022, auditors at the Inland Revenue Division (IRD) noticed a fluctuating trend in Goods Tax payments made by Solomon Islands Tobacco Company Ltd (SITCO) between 2015 and 2021.

IRD Commissioner Joseph Dokekana took no chances.

He assembled a team of senior audit investigators — including an officer from Customs & Excise who was brought in to be part of the team — then instructed them to conduct a thorough investigation into SITCO’s tax affairs.

Immediately, the audit team got down to work.

They visited SITCO’s factory in east Honiara, inspected its operations, reviewed numerous Customs import documents, and interviewed company officials.

In February 2023, the team came out with a detailed and explosive report: SITCO should have paid over $85 billion in unpaid taxes for that seven-year period.

According to the report, the total assessment included:

- Goods Tax discrepancy: $26,183,717,591.83

- Income Tax discrepancy (after 60% expense allowance): $58,913,364,581.63

- Total Tax discrepancy: $85,097,082,173.46

The audit team presented their findings to Commissioner Dokekana for further action.

Under IRD’s standard procedures, he was expected to issue the tax assessment to SITCO, giving the company an opportunity to respond.

However, the auditors claim Dokekana instead withdrew the $85 billion assessment and ordered it removed from the IRD system.

They say this decision followed a meeting held on 8 March 2023 between the Commissioner and SITCO representatives (without the audit team), along with a series of email exchanges.

The move deeply upset the audit team.

They argued Dokekana acted outside proper procedures and without legal basis.

“Our findings were based on official source document evidence,” the audit team insisted.

“They were objective, true, and correct,” it added.

“The findings represent substantial losses in government revenue in terms of excise duty, goods tax, and income tax.

“It’s incredibly disappointing to see the Commissioner reject the findings of an investigation he himself commissioned.”

In their effort to bring the findings to the attention of other government agencies, the audit team shared the report with the Ministry of Health and Medical Services, the Auditor General, the Attorney General, and the police.

At the Ministry of Health, the audit team actually did a presentation to the Permanent Secretary Pauline MacNeil and her senior officials.

In their letter to Attorney General John Muria Jnr, the audit team said Commissioner Dokekana called them for a meeting on 9 March 2023. This was after the Commissioner met with SITCO.

They said during their meeting, Dokekana told them the tax assessment issued will be withdrawn, with further directives to reverse the assessment from IRD’s revenue system.

“In our meeting, Dokekana indicated signs of intimidation by SITCO in which he clearly stated in his words ‘mi stopem oketa (SITCO) no go fastaem lo PMO’ and ‘mi fright for defendim this assessment’,” the letter reads.

The Attorney General never responded to the letter.

Manasseh Sogavare was prime minister at the time. When approached for comment, he told In-depth Solomons that he was unaware of the tax assessment and that no one had raised the matter with him.

Commissioner Dokekana told In-depth Solomons no one influenced his decision to withdraw the tax assessment.

He also defended his actions.

“The $85 billion tax assessment is absolutely unrealistic and manifestly inaccurate,” the IRD Commissioner said.

“It is clearly incorrect and not credible. It is far beyond the realms of reality,” Dokekana added.

“Under the Tax Administration Act, I have the authority to withdraw it to protect the integrity of the IRD.”

Dokekana added that withdrawing the assessment however, does not mean closing off the case.

“We will look into this case again,” he promised.

“But this generally depends on the availability and capability of auditors, the level of risk involved, the materiality of that risk, and the time required to conduct an audit.

“At this stage, we are more concerned about the capability of our auditors than any other factor—especially when it comes to auditing large multinational companies.

“Our reform program and efforts to improve the capacity of our auditors are ongoing at the IRD, with the support of our development partners.

“We believe this will eventually enable us to conduct professional audits of larger companies in the future,” Dokekana said.

The Audit Investigation

So, how did the auditors arrive at the disputed $85 billion figure?

The team focused on two key official source documents in their investigation:

- IM4 – Declarations for Excise and Goods Tax on finished cigarettes

- IM7 – Declarations for imported raw materials (cut rag tobacco)

They also conducted a physical inspection of the SITCO factory and bonded warehouse.

A subsidiary of global tobacco giant British American Tobacco (BAT), SITCO has operated in the Solomon Islands for over 50 years.

It is one of the country’s top five taxpayers and the largest of the three cigarette companies operating locally. The other two are Solomon Sun Cigarette Company and Oceanic Oasis.

One of the audit team’s key findings was SITCO’s purported failure to consistently submit mandatory monthly sales and production reports — documents legally required to support excise and goods tax declarations.

“These are critical documents required by law to accompany excise and goods tax declarations,” the audit team said in its report.

“The absence of these reports, which should detail stock levels, raw material usage, and finished goods output, was a serious breach of regulatory compliance,” it added.

“Consequently, there is no firm basis for the payment of the correct amount of excise and goods tax.

“Our inspection has established that the current data used for payment of excise and goods tax remains fictitious and incorrect, owing to the absence of these reports.

“It must be noted that all stocks held under storage bond are government property through revenues in excise and goods tax.

“Therefore, all standard operating procedures guiding stock reporting should be complied with accordingly, to ensure accuracy in stock levels.”

The audit team reported that it also found numerous inconsistencies in the customs import documents (IM7) relating to SITCO’s primary raw material—cut rag tobacco.

They said that the quantities declared on several IM7 forms were significantly lower than what was actually received.

“For some shipments, large container loads were declared to carry only a few hundred kilograms of cut rag, which contradicts the physical weight of a full container.

“This indicates under-declaration, a breach that severely undermines the correct calculation of excise and goods tax,” the report stated.

The report further noted instances where SITCO declared finished cigarette products as raw material—despite its legal classification as a manufacturer, not an importer of finished tobacco products.

These discrepancies, discovered in two IM7 declarations from 2015, point toward possible illicit tobacco imports, the report alleged.

Irregularities were also identified in SITCO’s IM4 declarations, pertaining to the final processing and excise payment of finished cigarette cartons.

The audit team pointed out that the declared output did not reconcile with the quantity of raw materials reportedly used, suggesting possible manipulation of figures.

In one glaring instance, a 2021 IM4 declaration claimed the use of 176 million kilograms of raw material in a single batch, enough for an entire year of production.

The report said SITCO’s Head of Marketing, Scott McIlride, later admitted this figure was “unrealistic.”

Company officials blamed third-party clearing agents for the errors, but the audit team pushed back, arguing all Customs documentation originates from SITCO itself.

They also flagged contradictions between internal departments.

While the Head of Operations said all Customs records since 2016 were available, the Head of Finance, Vivian Yu, reportedly told the auditors some were missing.

The audit team pointed out that it was from these official source documents from Customs that the $85 billion tax discrepancy figure the commissioner has dismissed came from.

“That figure just does not come out of the blue. It came out from the numerous official documents that we’ve reviewed for the years 2015 to 2021.”

Separate Matter

Responding to these allegations of illegal activities, Dokekana said these are quite separate matters.

“Whether a company is or was engaged in illegal activities is a separate matter of investigation,” he said.

“The tax assessment must stand on its own merits. When making decisions to withdraw we always take this into consideration,” the IRD Commissioner added.

“Where breaches of the revenue acts have occurred, IRD will take appropriate action.

“Investigation of illegal activities that relate to other statutes is the responsibility of other government agencies.

“Under tax audit, IRD is responsible for conducting formal investigations of financial information to verify individuals or corporations have accurately reported and paid their taxes.

“Illegal activity must be brought to the attention of IRD management and our legal personnel, to enable the appropriate authorities to be notified as a matter of urgency.

“There must also be evidence of such activity. In any case where it is suspected illegal activity has occurred, it is contingent upon IRD to put this to the taxpayer rather than make assumptions.”

SITCO: We Are Committed to Tax Laws

SITCO declined In-depth Solomons’ request for an interview but responded instead through their lawyer, Sol Law, in a hand-delivered letter.

“SITCO is aware of the historical and confidential IRD assessment referenced in your correspondence,” lawyer Silverio Lepe wrote.

“SITCO fully cooperated with the IRD during their assessment,” Lepe added.

“Following a comprehensive review of the calculations and methodologies used, the IRD assessment was withdrawn and rendered null and void in March 2023. Accordingly, that assessment is no longer relevant.”

Lepe continued:

“SITCO is committed to full compliance with the tax laws and regulations of Solomon Islands.

“We respect the work of agencies such as the IRD and Customs in ensuring all companies in Solomon Islands pay their fair share of tax.

“We maintain an open and constructive dialogue with these bodies on compliance matters.

“As a large multinational organisation, SITCO takes legal compliance and its corporate reputation very seriously.

“Given that the IRD assessment was officially withdrawn and noting the confidential nature of such assessments, SITCO will take very seriously any public statements that may be published that suggest any potential wrongdoing by SITCO.

“SITCO reserves its right to pursue all available legal remedies, including but not limited to commencing a defamation claim in relation to any defamatory statements that may be published in relation to this issue.”

It Cannot Be Real

For New Zealander Andrew Minto, a former IRD Commissioner now working as adviser to Dokekana, the $85 billion tax assessment cannot be real.

“I’ve never ever seen in my entire career a situation where a tax assessment of this size has ever been issued,” Minto told In-depth Solomons.

“You would have to go to places like America to see assessments of this size being issued that run into hundreds of millions of dollars,” he added.

“So that was the first red flag.”

He said enforcing such an assessment would have crippled SITCO’s operations.

“IRD collects only about $2 billion annually. SITCO couldn’t possibly owe that much,” he stated.

Minto concluded that Dokekana was right to withdraw the assessment.

Due Process?

However, local independent auditors In-depth Solomons spoke to, said due process should have taken place before the Commissioner withdrew the assessment.

“For assessments based on official source documents, the law requires the taxpayer to object within a set period — not for the Commissioner to unilaterally withdraw it,” a former IRD senior tax auditor told In-depth Solomons.

“If the taxpayer provides satisfactory evidence, then an amended assessment is issued. But in this case, none of that happened,” the auditor, who cannot be named due to his current employment status, explained.

“For the Commissioner to dismiss the assessment at first sight simply because the amount is huge smacks of ignorance and irresponsibility.

“The only way to determine the accuracy or inaccuracy of the tax assessment is for SITCO to dispute it with counter-evidence.”

He added that the audit team’s decision to circulate their report widely with other government agencies suggests they are confident enough to defend their findings in court.

Local auditor Roger Townshend agreed.

“I’ve reviewed the audit report. It’s thorough, well-structured, and based on detailed calculations,” he said.

“In my opinion, the assessment should have been issued. The burden would then be on SITCO to respond.”

Commenting on the report, Townshend said it looked highly credible.

“The members of the Audit Team are experts in their job. I believe they perform their duties in good faith and due care.”